First you have-ta FAFSA

October 4, 2021

Various amounts of money have been lost by parents and even students throughout 2020 and 2021 due to the COVID-19 pandemic restricting along with reducing the availability of gaining a job and being able to work.

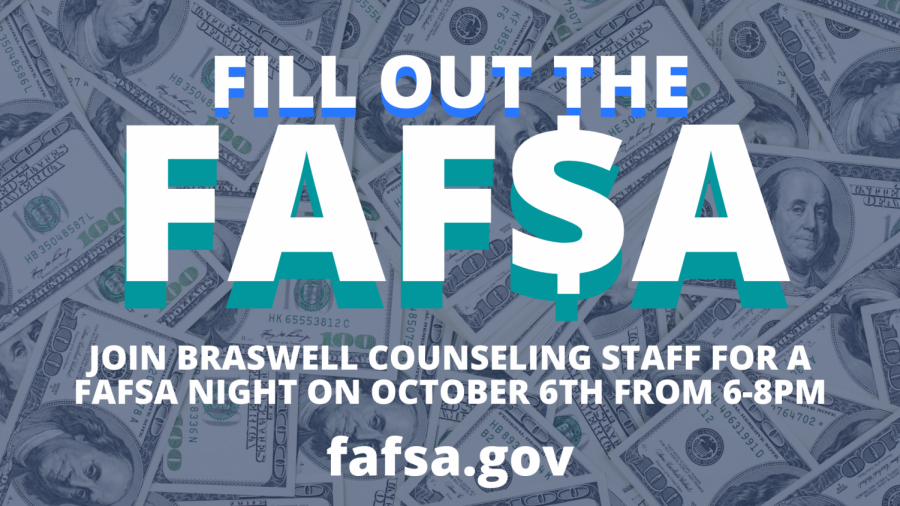

Because of this, many students question where they are going to get the money to pay for college expenses such as room & board, book fees, tuition, and many other expenses. FAFSA can be used to help with these expenses and is easily accessible online. However, it is important for those completing the form to remember there are two parts to the application where students are asked to complete an information section and the parents/guardians complete a separate information section.

“The FAFSA is the most important step in seeing what type of federal aid you qualify for,” guidance counselor Sarah Morales said. “Money awarded from the FAFSA can be combined with other scholarships, grants, etc. to pay for school.”

The U.S. Department of Education looks at the household’s income along with many other contributing factors which can help predetermine what the expected contribution might be. The application then bases whether families and students are awarded with free money in the form of grants, part-time work opportunities where earnings go toward costs of school, or even low-interest student loans.

“Although loans can be daunting, these loans often have much lower interest rates than the loans you would get from a private borrower like another bank or loan company,” said Morales.

Completing the FAFSA isn’t a challenge as long as students are prepared in advance by having gathered all of the required documents needed to complete the application. For example, it would be beneficial to have a guardian nearby when filling out the parent/ guardian section of the form.

“Do not use your student email address as your email address for your FAFSA ID because you will need to complete the FAFSA each year you are in school,” Ms. Morales said, “and once you graduate high school, your school email address is deleted and you lose access.”

Students are also encouraged to pay attention to the deadlines. The application for the 2022-2023 incoming college freshmen opens Oct. 1, 2021, with the priority deadline being Feb. 1, 2022. However, the application will remain open until June 30. Seniors are encouraged to complete the application prior to the February deadline to ensure the most money as funds are distributed on a first come first serve basis in Texas.

“It is important to keep deadlines in mind while filling out the FAFSA,” Morales said. “Thankfully, for any difficult questions or general confusion, we have amazing resources available to our students to help families complete the FAFSA.”

One fact that is not well known, is students have a choice as to whether or not they would like to accept all of the money or loans they are awarded, and can choose to accept just a portion or all of it.

“For example, if you only qualify for loans, you do not have to accept any loans or you can even accept just partial amounts of loans,” Morales said. “There is no harm in completing the FAFSA even if you do not accept the award. It is okay if your financial circumstances change after completion.”

Although it is easy to get caught up in the whirlpool that came from 2020-21, with a new year just beginning, it is time to start thinking about the future. This future beginning with filling out the FAFSA and gaining financial benefits towards achieving the goal of a college education.